Monthly: Voluntary Carbon Market Updates (January 2024)

This article is an automatically translated version of the original Japanese article. Please refer to the Japanese version for the most accurate information.

This is sustainacraft Inc.'s newsletter. This time, as a Monthly VCM Update, we will introduce two reports published in December 2023, positioned as guides for buyers of biodiversity credits. Biodiversity credits have been covered multiple times in this newsletter, as shown below, but those articles were all technical, introducing methodologies.

These reports are aimed at buyers and should be easier to read compared to previous articles related to biodiversity credits.

Over the past six months, our company has visited Brazil three times (to states such as Amazonas, Bahia, and Mato Grosso do Sul). Forest restoration is emerging as a new industry in Brazil. There are several initiatives attempting to scale the challenging task of restoring native forest species by combining sophisticated operations honed through commercial forestry of monoculture species like eucalyptus, which has been industrialized, with research findings on native species and ecosystems developed over many years by academic institutions.

While the Amazon rainforest and the Atlantic Forest in Bahia state are both incredibly beautiful, upon returning to Japan, I find Japan's nature even more beautiful than I had previously perceived. Japan has many steep slopes, and land ownership is fragmented into small parcels, which might make scalable initiatives difficult. However, these slopes contribute to the unique beauty of the Japanese landscape.

Our company has also started activities this fiscal year aimed at improving natural capital and biodiversity in Japan's terrestrial and coastal areas, as well as quantifying these improvements, with the goal of creating biodiversity credits. Please allow us to introduce these initiatives on another occasion.

Apologies for the long introduction; here begins this month's content.

Announcements

I will be speaking with Sumitomo Corporation at the JICA Forest to Change the World Platform seminar, "REDD+ Related Initiatives by Private Companies." Please register here. This will be an online event.

[Date/Time] Friday, February 9, 2024, 15:30 - 16:50

[Venue] Online (Microsoft Teams)

Monthly VCM Update

This month, we will introduce the following:

A. Voluntary Carbon Credit Market Trends

- Issuance / Retirement Analysis

- Project Pipeline Analysis

B. Trends in Major International Regulations

- Biodiversity Credits: A Guide to Support Early Use with High Integrity (World Economic Forum)

- Demand-side Sources and Motivation for Biodiversity Credits (Biodiversity Credit Alliance)

A. Voluntary Carbon Credit Market Trends (Verra)

1) Issuance / Retirement Analysis

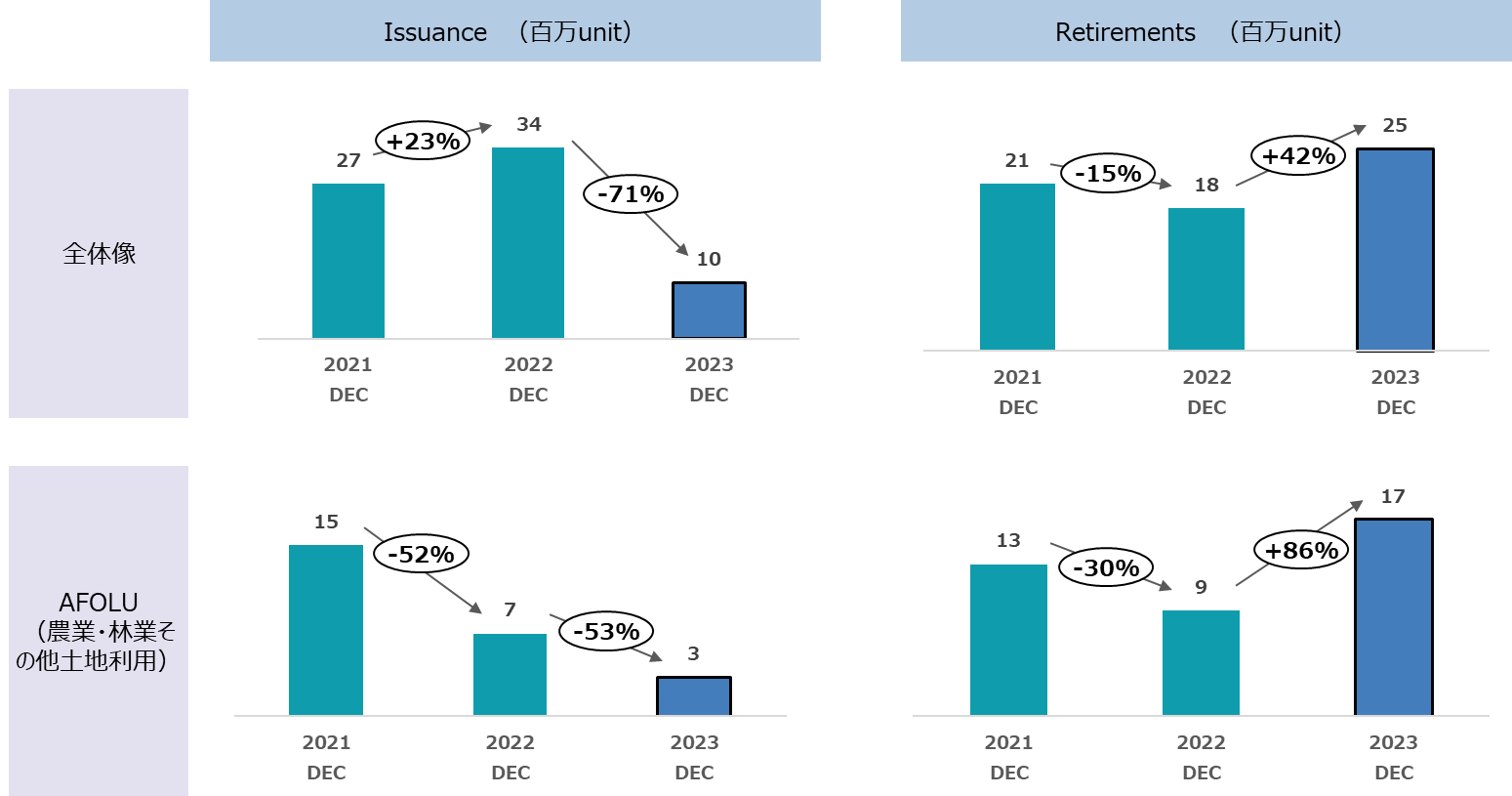

In December 2023, 9,848,142 units of Verra Voluntary Carbon Credits were newly Issued, and 25,243,346 units were Retired. This represents a -71% and +42% change year-on-year for Issuance and Retirement, respectively.

Limiting to AFOLU (Agriculture, Forestry and Other Land Use) projects, 3,395,787 units were Issued, and 17,273,573 units were Retired. These figures show a year-on-year change of -53% and +86% respectively, indicating an increase in Retirements.

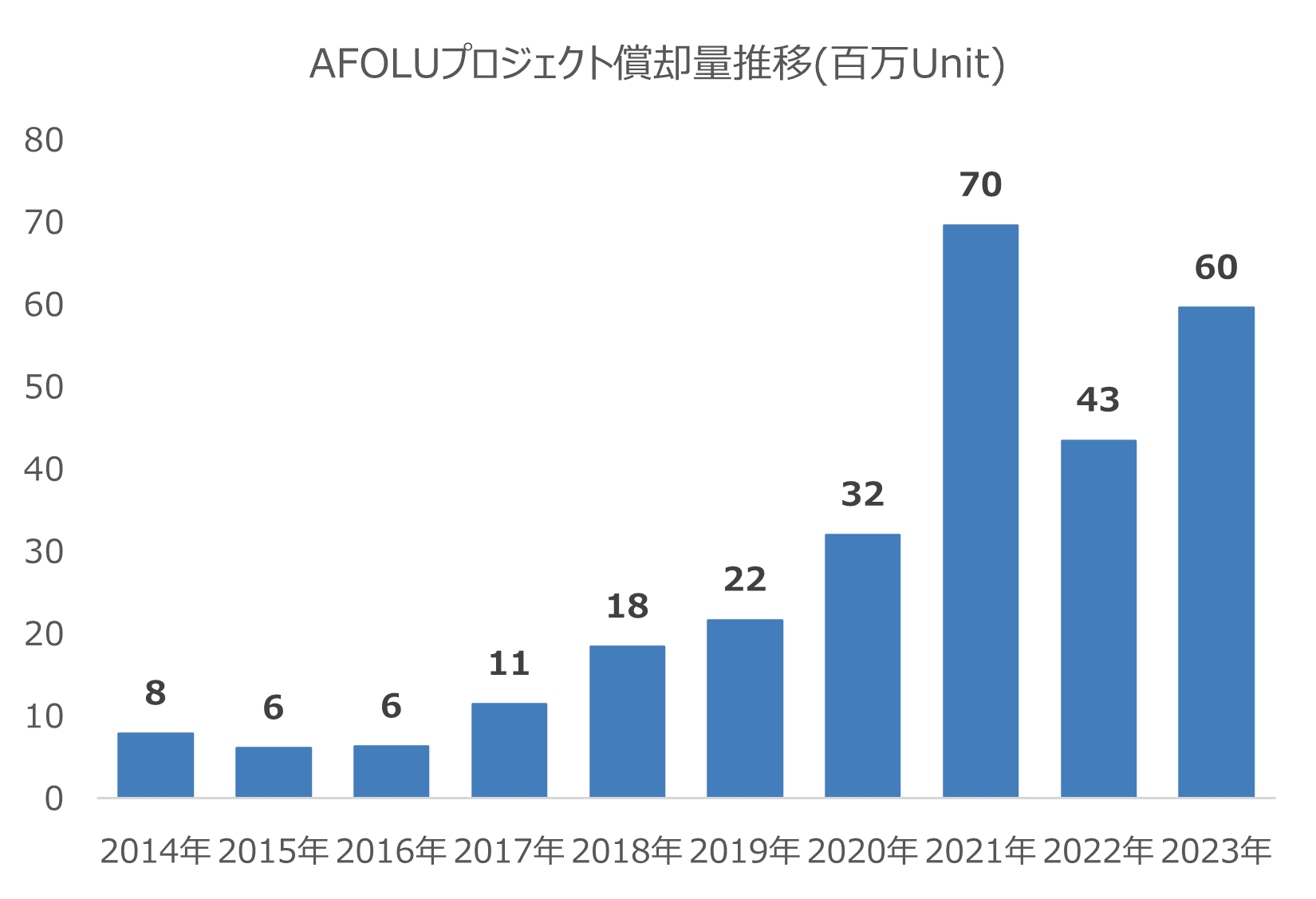

This shows the trend in Retirement volume for AFOLU projects over the past 10 years. In 2023, the volume was 59,519,223 units, an increase of +37% year-on-year. Although not reaching 2021 levels, the Retirement volume has turned to an increase.

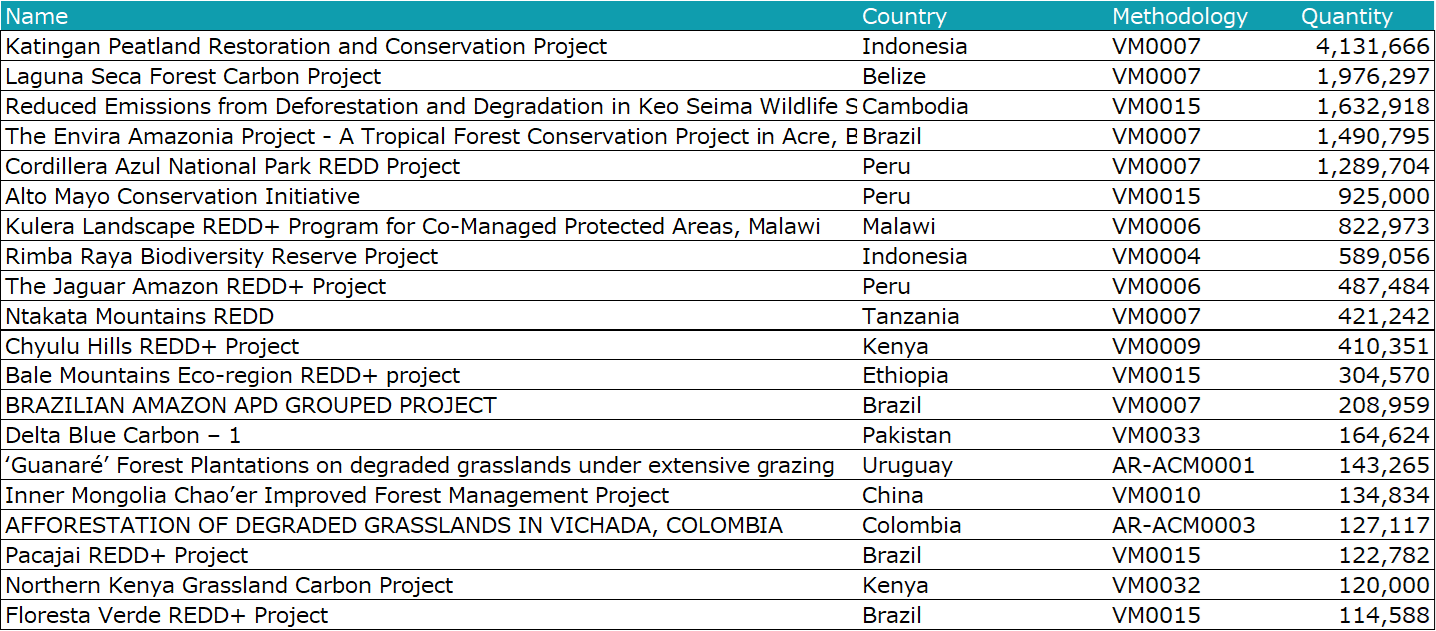

Here is a list of projects Retired in December 2023 (AFOLU sector only). The top 20 projects account for 60% of total Retirements. By country, Indonesia is the largest (27%), followed by Peru (17%), Brazil (13%), Belize (11%), and Cambodia (10%).

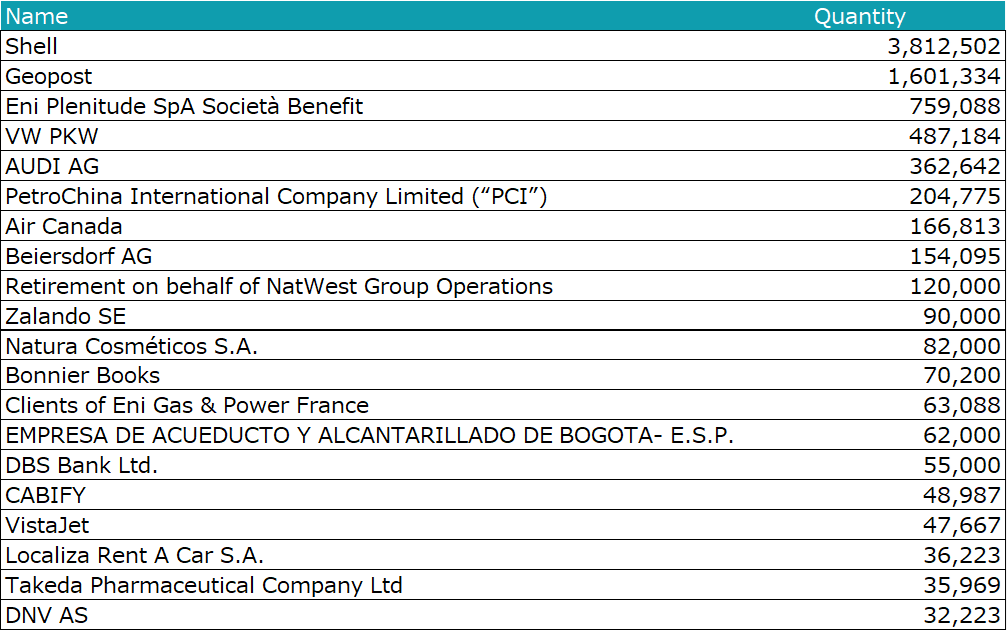

The top 20 companies that Retired Carbon Credits from the Verra AFOLU sector are listed below. Consistent with last month, Shell's Cancellation volume is extremely large. Geopost, ranking second, is a land transport and parcel delivery operator primarily active in France. The company has announced its aim to reduce emissions by 90% by 2040 compared to FY2020, based on SBTi guidelines, and to neutralize Residual Emissions by purchasing Removal-based Carbon Credits from activities such as Afforestation. The current Cancellation volume of 1.6 million tons is close to their 2022 emissions of 1.8 million tons (total Scope 1-3). It is a speculation, but this 1.6 million tons Cancellation might be the result of neutralizing all Residual Emissions for FY2023.

2) Project Pipeline Analysis

As mentioned in a previous article, we have published the Voluntary Carbon Credit market trend report up to the end of 2023, which was used in a seminar at the end of last year (English version, Japanese version).

This report covers both demand and supply sides, but in this section, I would like to describe the supply-side trends from this report.

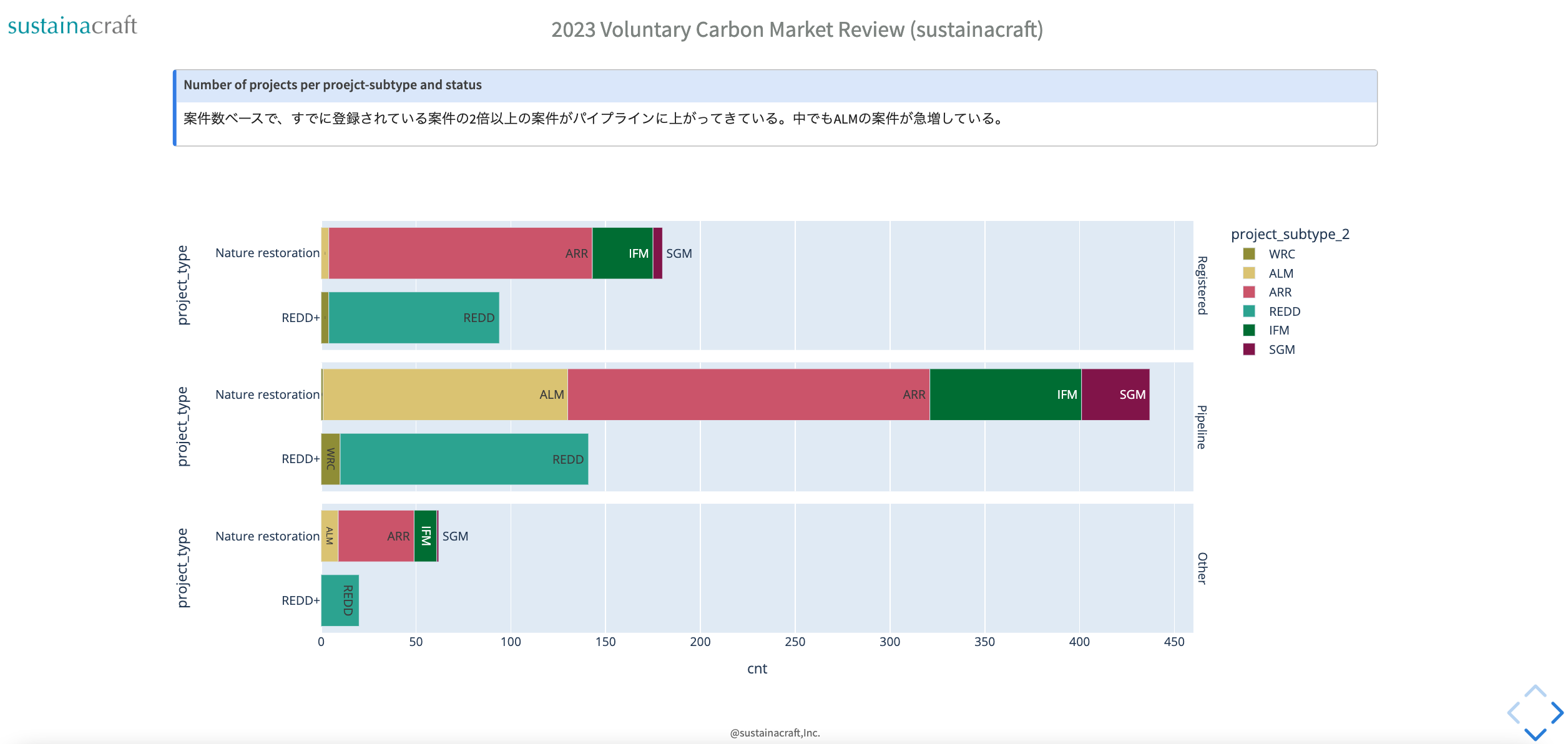

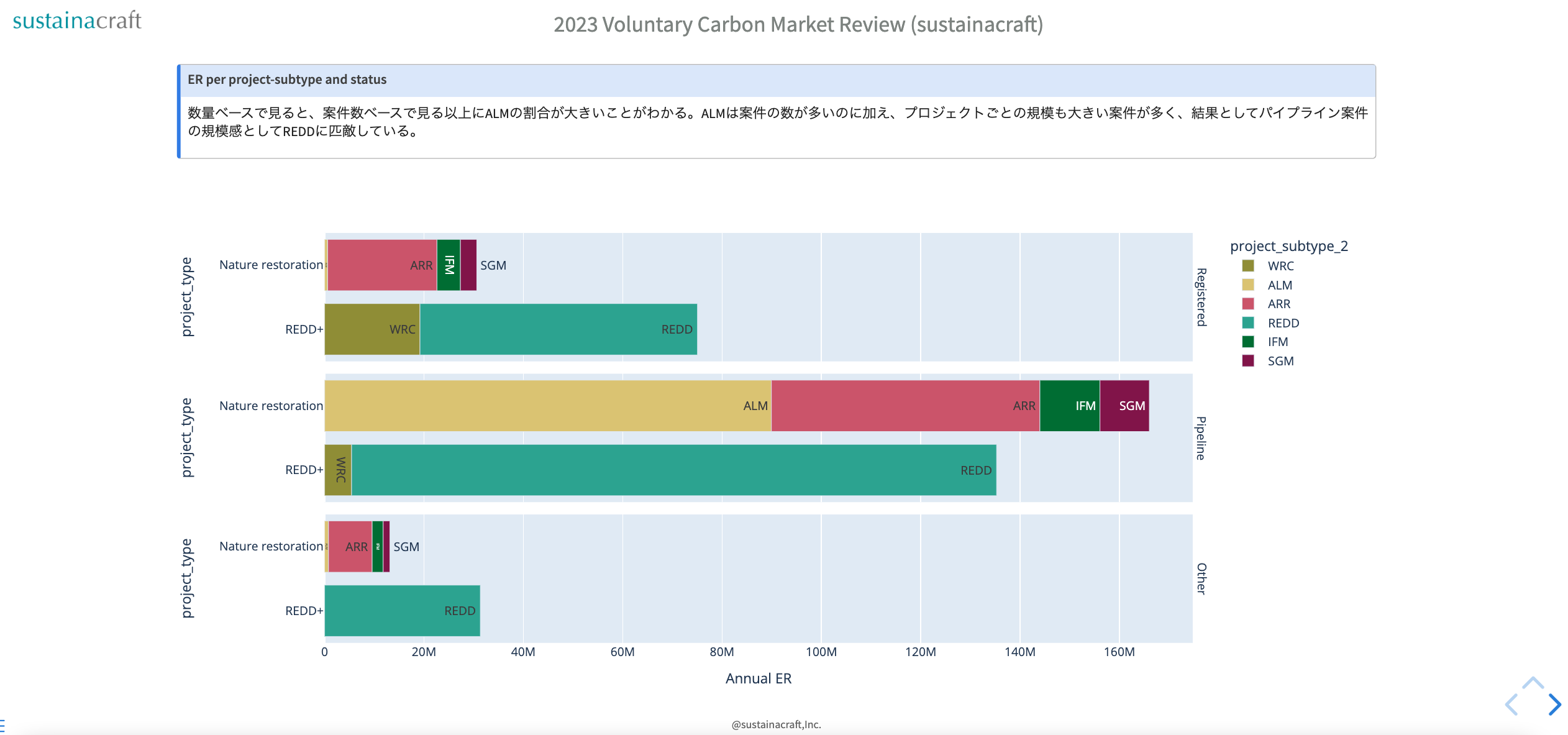

The figures above show the number of natural-based projects by project type (upper panel) and annual Emission Reduction / Sequestration volume (lower panel), categorized by project status (from top: Registered projects, Pipeline projects, others).

From these, it can be seen that both the number of projects and the annual GHG Emission Reduction / Sequestration volume are increasing at an unprecedented pace. In addition to a large number of ARR (Afforestation, Reforestation and Revegetation) projects, ALM (Agricultural Land Management) projects are particularly noteworthy; while there are almost no ALM projects currently Registered, their number is expected to explode in the future.

As the total volume is expected to become comparable to REDD+, it is highly likely that in the near future, ALM1 projects will face increasing criticism regarding quality risks, similar to what REDD+ has experienced. In the case of ALM, Additionality is a particular concern. It is crucial to carefully assess whether these activities, which have historically been implemented in some form of livestock farming or crop production, would not occur without Carbon Credits.

Nevertheless, we believe that ALM activities are very important. While the mechanisms of natural capital loss vary by location, we generally consider three key perspectives: food security, conservation of existing nature, and natural restoration. Restoration requires both money and time, so funding must also be directed towards conservation. Meanwhile, with the global population continuously growing, ensuring food supply is essential. ALM, REDD+, and ARR respectively correspond to producing food with minimal environmental impact, conserving existing nature, and restoring degraded or lost nature.

In the future, Credits with CCP (Core Carbon Principles) labels and "Removal-based" labeled Credits, which are expected to be used by SBTi, will enter the market. While procuring based on such "labels" might seem straightforward for companies, I believe it is important to be careful not to let finance become biased towards one type.

While it cannot be generalized, ALM generates Removal-based (and combined with Avoidance) Credits, and the project implementation costs are often assumed to be lower than those for native species Afforestation projects. If merely purchasing "Removal-based" labeled Credits, they might appear more attractive than ARR in terms of both volume and price. While labels like CCP and Removal-based can serve as references, we believe it is primarily crucial for each company to establish its decarbonization and nature-positive policies and then formulate a long-term procurement strategy in accordance with those policies.

Below, we show the monthly Pipeline trends for each project subtype. The upper panel shows the number of projects, and the lower panel shows the annual ER (Emission Reduction) basis. The horizontal axis is based on the Listing Date2.