December 2025 VCM Updates: Section A

This article is an automatically translated version of the original Japanese article. Please refer to the Japanese version for the most accurate information.

VCM Updates Section A: Voluntary Carbon Credit Market Trends

This is a newsletter from Sustainacraft Inc. This article is Section A (Market Trends) of VCM Updates (Voluntary Carbon Market Updates).

*Author of this article: Michelle Appeah (Business Development Manager)

«VCM Updates Structure»

A. Voluntary Carbon Credit Market Trends ← Subject of this article

- Credit Issuance, Retirement, and Investment Trend Analysis

- Project Pipeline Analysis

- Detailed Analysis Section

B. Trends in Major Overseas Regulations

Introduction

This month's newsletter covers Carbon Credit Issuance and Retirement data for November 2025.

Credit Issuance Performance

While Issuance volume in November 2025 was similar to the same period last year, Retirement volume showed a decreasing trend compared to the same period last year. Regarding trends in labeled Credits, CORSIA and Article 6 labels were observed for Cookstoves projects in Rwanda and Gambia. Removal labels were issued only for US IFM (Improved Forest Management) projects, and CCP (Core Carbon Principles) labels were issued for the same US IFM projects, as well as for ozone-depleting substance projects in France.

Project Pipeline Trends

In November, 10 new Nature-based Solutions (NbS) projects and 6 CDR (Carbon Dioxide Removal) projects were confirmed as Registered. These include IFM projects in Peru and Mexico, and ARR (Afforestation, Reforestation and Revegetation) projects in India and Tanzania. The October Pipeline was updated after last month's newsletter publication, with 4 additional projects, including a REDD (Reducing Emissions from Deforestation and Forest Degradation) project in Indonesia. From a carbon market perspective, Peru and Tanzania are particularly noteworthy, and the reasons will be discussed later.

Investment Trends

18 investments in Nature-based Solutions and CDR projects were confirmed, with capital inflows from diverse entities such as asset management companies, corporate consortia, energy companies, and major mining firms. In the Nature-based Solutions sector, notable long-term capital movements centered on agricultural, forest, and grassland regeneration include a $30 million investment by French asset management company Mirova into a regenerative agriculture project in India, and the launch of a large fund for Brazil involving participants such as the US-based Moore Foundation and the Norwegian government's International Climate Initiative (NICFI). Forest regeneration investments in Brazil by Nestlé and IKEA demonstrate corporate commitment to achieving both decarbonization and Biodiversity.

Meanwhile, in the CDR sector, progress was made in Offtake Agreements via Frontier by companies like Google and McKinsey, TotalEnergies' CCS research investment, and funding for advanced technologies centered on DAC (Direct Air Capture) and ERW (Enhanced Rock Weathering). Long-term Offtake Agreements and strategic investments by emissions-intensive sectors are increasing, and CDR investments are evolving from reliance on single technologies to a portfolio approach combining multiple technologies.

A. Voluntary Carbon Credit Market Trends

A-1: Credit Issuance, Retirement, and Investment Trend Analysis

- Target Registries: Verra (VCS), Gold Standard (GS), Climate Action Reserve (CAR), American Carbon Registry (ACR), ART-TREES, Puro.earth, Isometric

- Target Period: November 2025

- Notes: Please be aware that companies are not obliged to register their names with the registry for Retirements, so accuracy cannot be guaranteed. Also, there may be delays in reflection on the registries, so please note that project numbers and status changes may occur for this target period in the future.Issuance and Retirement performance for November 2025 is as follows:

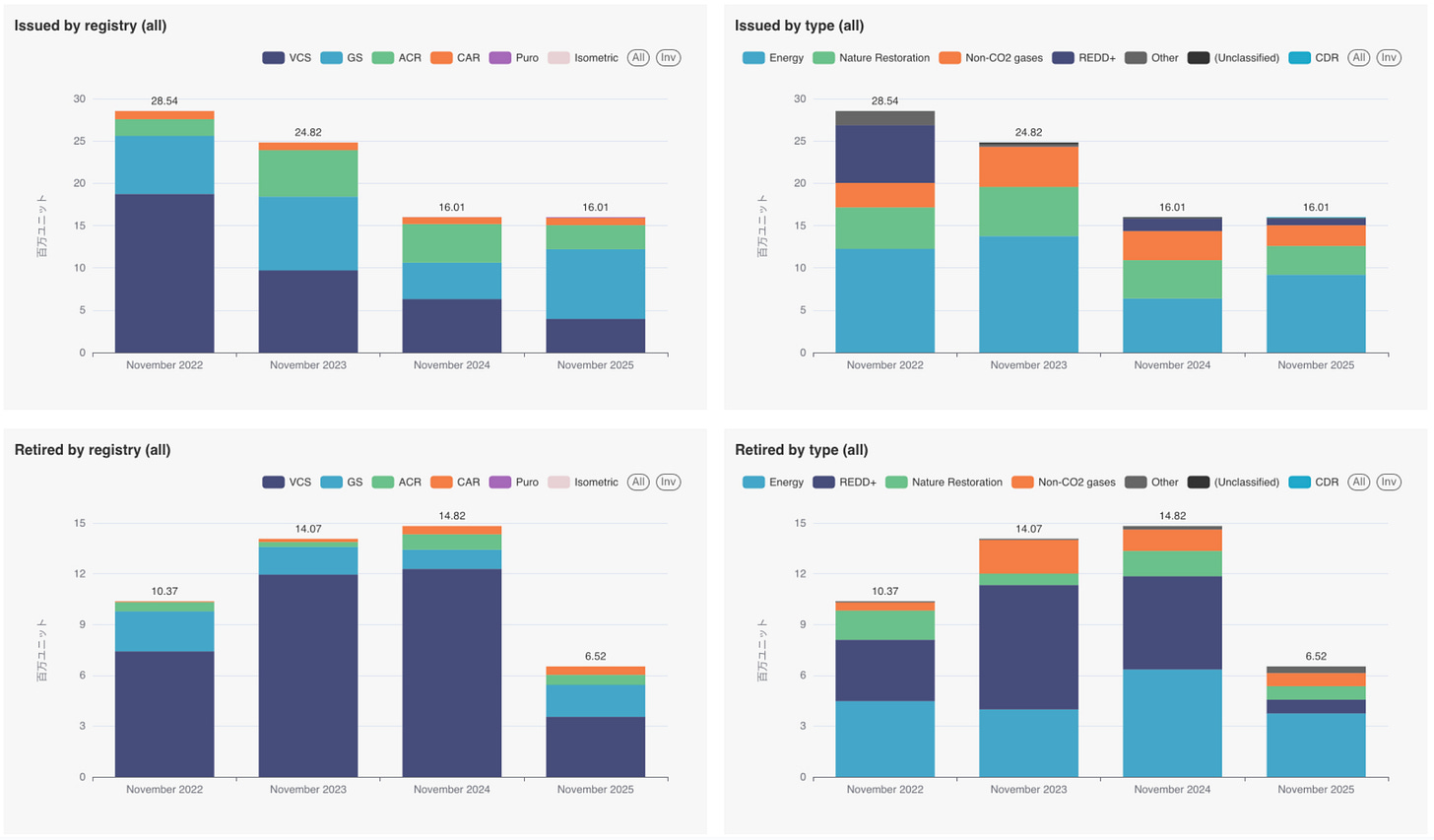

- Issuance Performance: 16.01 million (similar to the same period last year)

- The number of Credit Issuances during the target period remained at the same level as the previous year and again fell below 20 million units.

- Looking at data by registry, Gold Standard (GS) increased significantly, accounting for more than half of the total. Meanwhile, Verra (VCS) continued its decreasing trend year by year, accounting for 25% of the total this time.

- By type, energy (mainly GS and VCS) increased, accounting for more than half of the total for the first time in two years. Meanwhile, non-CO2 gases, nature restoration, and REDD (GS and VCS) slightly decreased.

- Retirement Performance: 6.52 million (56.01% decrease compared to the same period last year)

- Retirements in November significantly decreased compared to the same period last year, falling below 10 million units.

- Looking at the proportions by registry and project type, VCS again accounted for the majority, but the Retirement volume decreased. While Retirements from energy projects increased to more than half of the total, REDD significantly decreased, accounting for about 10%.

<List of Issued Projects>

The Credit labels displayed below are all based on information provided by each certification body (registry). Therefore, please note the following:

・Even if a Methodology itself is CORSIA eligible or CCP approved, it will not be counted as a labeled Credit in the table below unless the registry's data includes label information.

・Only Verra (VCS) and Gold Standard (GS) registries provide Article 6 label information.

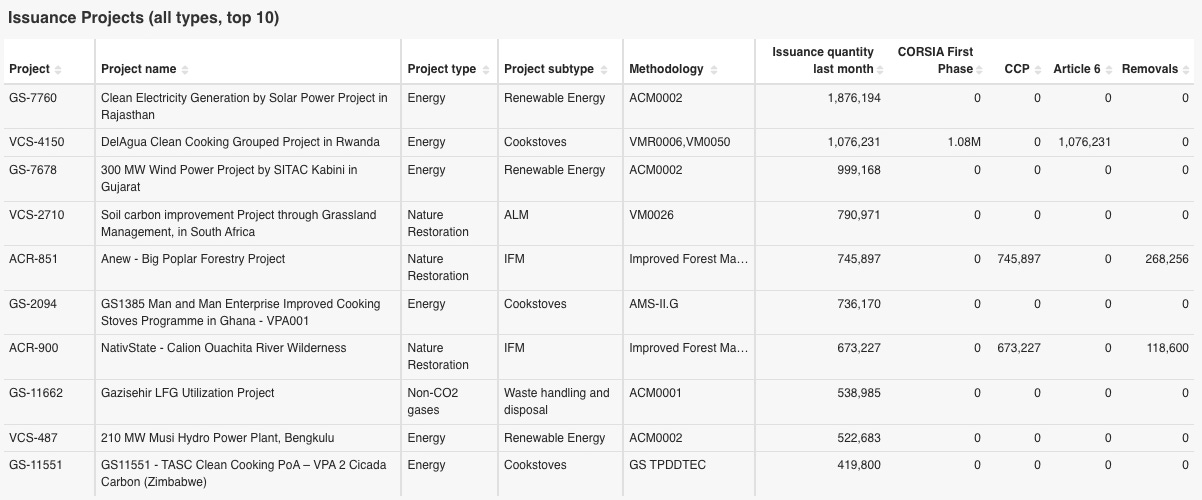

Below is a list of the top 10 projects for which Credits were Issued in November 2025, and projects with labels (Article 6, CCP, CORSIA, Removal) Issued.

Top Issued Projects List

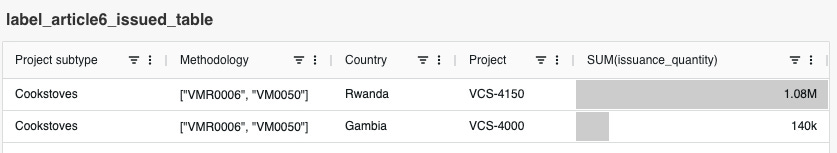

Label Issuance Performance (Article 6)

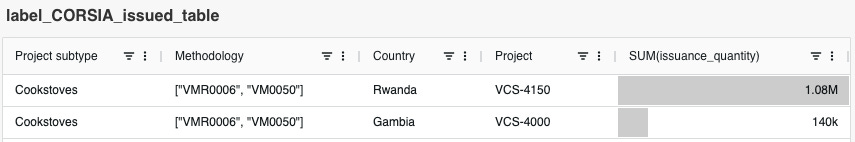

In November, the number of projects significantly decreased compared to the previous month. Article 6 labels were Issued for Cookstoves projects in Gambia and Rwanda. Looking at cumulative Issuance performance to date, the aforementioned Cookstoves project in Rwanda (VCS-4150) accounts for approximately 50% of the total. Meanwhile, the Cookstoves project in Gambia (VCS-4000) accounts for 3% of the total.

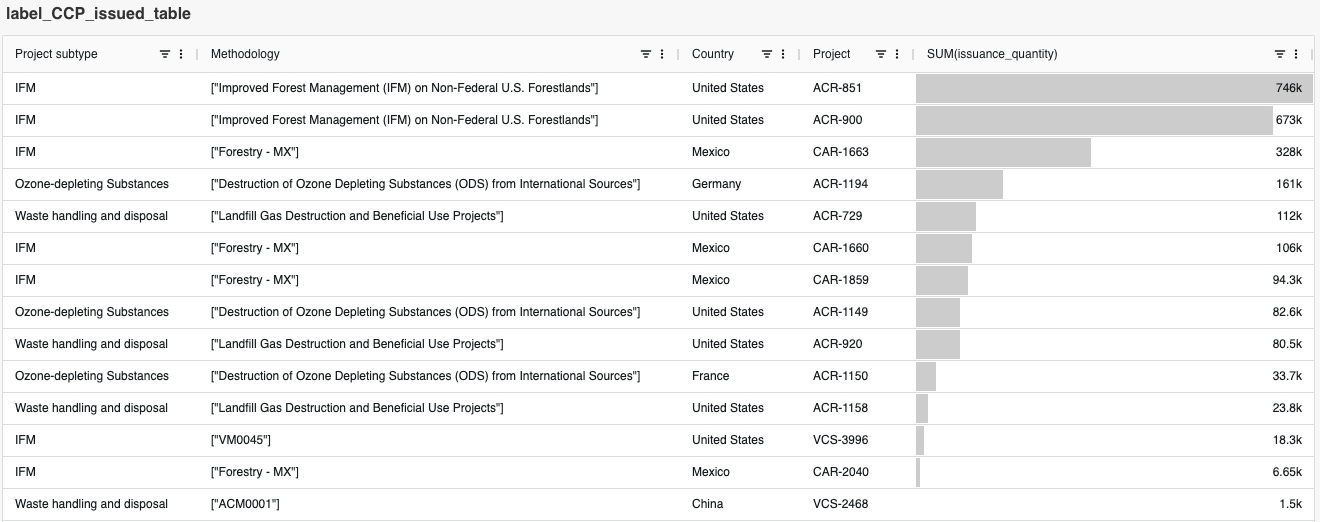

Label Issuance Performance (CCP)

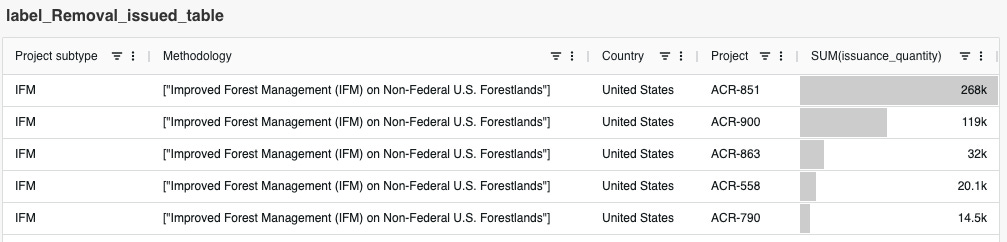

Regarding CCP labels, in November, they were Issued for IFM projects in the US and Mexico, waste treatment projects in the US and China, and ozone-depleting substance projects in Germany, France, and the US. The largest Issuance volume was from a US IFM project (ACR-851), with 746,000 units. Cumulatively, Issuances from IFM projects account for approximately 10%.

Label Issuance Performance (CORSIA)

In November, a total of approximately 1.22 million CORSIA labels were Issued for the aforementioned Cookstoves projects in Rwanda and Gambia (VCS-4150, VCS-4000), which also received Article 6 labels (Phase 1, Vintage 2021-2024). For Phase 1 (2024-2026), an LoA (Letter of Authorization) is required for all Vintages (2021-2026). Since an LoA is required for the Credits confirmed as Issued this time, it was confirmed that LoAs had been Issued for Rwanda by 2023 and for Gambia by 2024, respectively.

Label Issuance Performance (Removal)

Finally, regarding Removal labels, in November, they were Issued for five US IFM projects (all ACR). The largest Issuance volume was from the aforementioned project (ACR-851) that also received a CCP label, with approximately 270,000 units. Looking at cumulative Issuance performance to date, US IFM projects account for approximately 90%.

<List of Retired Projects>

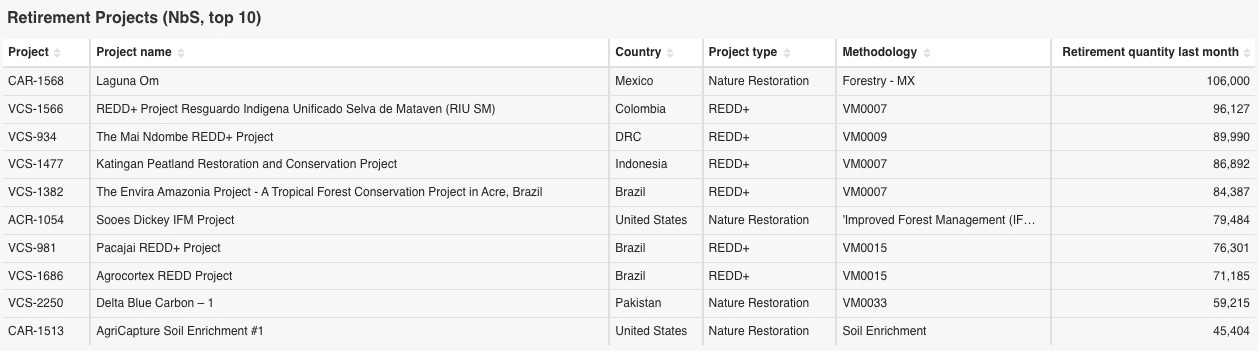

Below is a list of the top 10 Nature-based Solutions projects with the highest Retirement volumes in November 2025.

The largest Retirement was from an ARR project in Mexico (CAR-1568), with over 100,000 units Retired. This marks the largest Retirement volume ever for this project.

<List of Retiring Companies>

Below are the top 10 companies that Retired Credits from Nature-based Solutions projects in November 2025.

The company that Retired the most was Vista Jet, an airline from Malta, with approximately 100,000 units. To date, the company has cumulatively Retired 400,000 units from REDD and nature restoration projects. These include the large-scale REDD project Kariba (VCS-902) in Zimbabwe and the Agrocortex project (VCS-1686) in Brazil.

<Investment Trends in Nature-based Solutions and CDR Projects>

- Target Projects: Covers investments in Nature-based Solutions and CDR.

- Target Period: November 2025

Notes: For "Credits" and "Group investment" amounts, only publicly announced figures are recorded, so some fields may be blank. In this table, "Beneficiary" refers to the investing company or the Credit Buyer, and "Investment into" indicates whether the investment target is a project or a fund.

In November, there were 18 significant investments in Nature-based Solutions and CDR projects. For details, please refer to A-3: Detailed Analysis Section.

A-2: Project Pipeline Analysis

- Target Registries: Verra (VCS), Gold Standard (GS), Climate Action Reserve (CAR), American Carbon Registry (ACR), ART-TREES, Puro.earth, Isometric

Target Projects: Pipeline related to Nature-based Solutions and CDR

Target Period: October-November 2025

Notes: Please note that there may be a slight time lag in reflection on the registries, so there is a possibility of changes in the number of projects or their status for this target period in the future.

Terminology: Annual ER refers to the annual Emission Reduction / Sequestration volume (tCO₂e).This section covers new Pipeline projects related to Nature-based Solutions and CDR from last month, as well as updates to the Pipeline from the month before last, which were introduced in the previous newsletter.

Please note that the application dates (Listing Dates) in this database are either directly obtained from the registries or estimated. Therefore, the completeness and accuracy of the data cannot be guaranteed.

<Nature-based Solutions Project Pipeline>

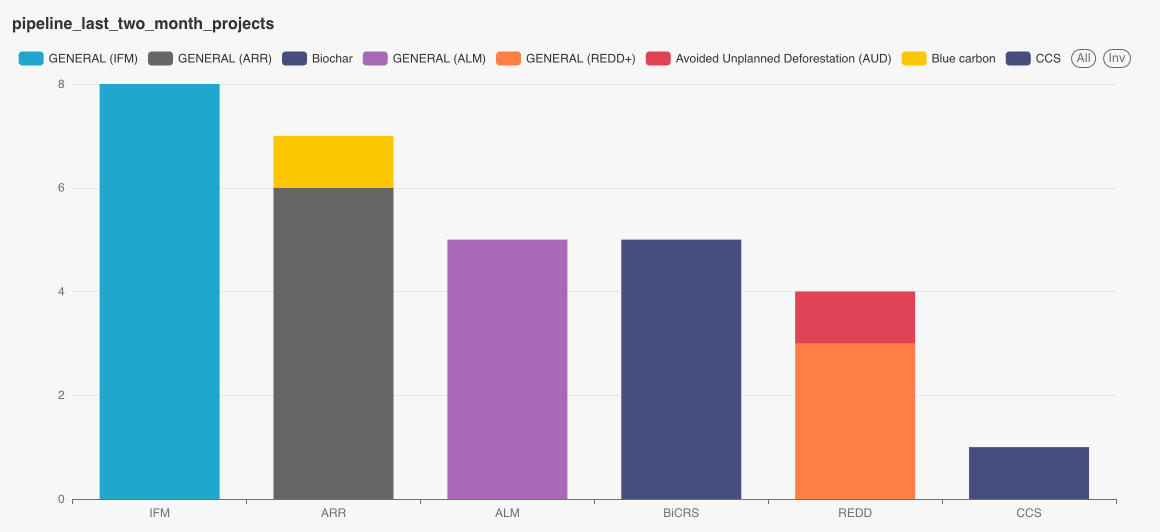

The November 2025 Pipeline includes 16 projects, and the October Pipeline, updated after last month's newsletter publication, now includes 14 projects.

Over these two months, IFM projects account for the largest number of projects. Most of these are CAR projects in Mexico (4 projects) and ACR projects in the US (2 projects), followed by projects in Canada and Peru.

The November Pipeline includes ALM (Agricultural Land Management) projects in Mongolia, Sierra Leone, and Malaysia; IFM projects in Peru and Mexico; and ARR projects in India and Tanzania. Due to potential time lags in information sharing by registries, four additional projects were added to the October Pipeline since the previous month's newsletter was written: a REDD project in Indonesia, an ALM project in China, an ARR project in Portugal, and an IFM project in the US.